WE INVITE YOU TO THE 📈

Level Up Institutional Trading Summit 2024

Transform your trading in just 2 days! At the Level Up Institutional Trading Summit, you’ll dive into hands-on exercises and advanced institutional trading strategies designed to help you become a walking ATM. Stop relying on retail concepts and master the institutional frameworks that truly drive the markets.

- Miami, FL

- December 14-15th

Get An In-Person Ticket for December 14-15, 2024

WE INVITE YOU TO THE 📈

Level Up Institutional Trading Summit 2024

Transform your trading in just 2 days! At the Level Up Institutional Trading Summit, you’ll dive into hands-on exercises and advanced institutional trading strategies designed to help you become a walking ATM. Stop relying on retail concepts and master the institutional frameworks that truly drive the markets.

- Miami, FL

- December 14-15th

Get An In-Person Ticket for December 14-15, 2024

Our Trusted Event Partners

As Seen On

Mastering Market Moves: An Anstitutional Trading Summit

Level Up Quant Vue

Institutional technical analysis software for actionable insights

Institutional Alerts

A suite of real-time, actionable alerts used by professional traders

Exclusive Handbook

Your complete guide with precise entry models and trading setups

Fireside Chats

Engage with hedge fund managers and market makers to gain insider knowledge

Hands-On Exercises

Apply what your learn in real-time, backed by expert guidance

BECOME A WALKING ATM IN

JUST 2 DAYS

knowledge 📈

Real-Time Application Hands-On Trading Exercises

Dive into practical learning with our hands-on exercises designed to reinforce your trading skills. In this interactive session, you’ll apply the concepts you’ve learned in real-time scenarios, guided by industry experts. Whether you’re refining entry models or executing trading setups, you’ll gain valuable insights and confidence to navigate the markets effectively. Join us for a dynamic experience that bridges theory with practice!

Summit Agenda 📈

Summit Agenda Elevate Your Trading Experience

1. Market Structure & Algorithm Fundamentals

Market Maker Model

Learn how market makers create liquidity and influence price movements.

Market Algorithm

Explore how institutions seek liquidity and rebalance unfair prices.

Why Retail Trading Concepts Fail

Discover why most retail strategies fall short and how institutions capitalize on these weaknesses.

2. Time and Price Theory

Time and Price Synergy

Understand how institutional algorithms manipulate liquidity through specific times and prices.

Precise Entry Models Based on Time

Precise entry models based on time use specific timeframes and patterns to identify optimal market entry points for trading.

3. Market Structure and Trade Setups

Market Structure Basics

Learn to identify swing highs, swing lows, and shifts in market structure.

Trade Setup Elements

Integrate market structure into reliable trade setups.

4. Liquidity Trading Concepts

Understanding Liquidity

Learn the key role liquidity plays in market movement.

Buy-Side & Sell-Side Liquidity

Recognize where liquidity pools form and how institutions target them.

Failure Swings & Candle Science

Study the importance of price action and failure swings in liquidity hunts.

5. AMD Phases of the Market

Accumulation, Manipulation, Distribution (AMD)

Learn to identify and trade within these institutional phases.

6. Imbalances and Fair Value Gaps

Fair Value Gaps

Identify and trade imbalances that offer key trading opportunities.

Inversion Fair Value Gaps

Learn how these gaps signal institutional activity.

7. Advanced Price Action Concepts

Breaker Blocks & Price Displacement

Master advanced tools to predict market reversals and track institutional presence.

8. Daily Bias and Timeframe Alignment

Daily Bias

Develop a daily directional bias based on institutional behavior.

Timeframe Alignment

Align macro and micro timeframes for more reliable setups.

9. Order Flow and Institutional Algorithms

Order Flow Analysis

Understand how institutions manipulate order flow to drive prices.

First Line of Defence & Last Line of Defence

Learn the key defenses institutions use to protect liquidity.

10. Weekly Framework and Calendar

Weekly Framework

Plan trades around the weekly calendar and high-impact events.

Escape the System,

One Withdrawal at a Time

Pro Toolkits 📈

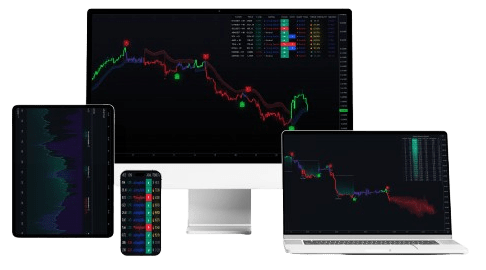

Level UP Quant Vue - Next Gen Institutional Software

Level Up Quant Vue: Institutional Trading Software

Unlock the Power of Institutional-Level Trading

At Level Up Enterprises, we’ve developed Level Up Quant Vue, an advanced institutional trading software designed to revolutionize how traders engage with the markets. Built from the ground up with the same principles and strategies that drive institutional success, our platform offers unparalleled precision, efficiency, and insight for traders ready to take their performance to the next level.

Why Level Up Quant Vue?

Our software isn’t just another trading tool—it’s a comprehensive system engineered to help traders understand and navigate the complexities of market algorithms. It allows users to gain the same tactical advantage enjoyed by institutional traders with access to real-time data, market structures, and liquidity points.

Advanced Algorithmic Insights

Level Up Quant Vue provides deep analysis of market patterns and liquidity flows, allowing traders to identify high-probability setups using institutional concepts like Fair Value Gaps, Order Blocks, and Time & Price.

Hands-On Tactical Tools

Execute trades with precision using our cutting-edge tactical tools, designed to assist with placing orders at optimal liquidity zones, identifying displacement and order flow changes, and monitoring volume imbalances in real-time.

Customizable Trading Models

Tailor the software to your trading style with customizable models that allow you to fine-tune indicators, set parameters for high-impact trades, and develop strategies based on institutional frameworks.

Real-Time Market Data Integration

The platform aggregates institutional-grade data, ensuring you’re always ahead of the curve. With built-in real-time updates, you can stay on top of the latest market shifts and price movements.

Elevate Your Skills at the Level Up Institutional Trading Summit 2024

- Miami, FL

- December 14-15th

Get An In-Person Ticket for December 14-15, 2024

Participants!

Unlock Your Trading Potential with Experts

At the Level Up Institutional Trading Summit 2024, industry experts will share their unique insights and strategies to help you elevate your trading skills and navigate the markets confidently. Get ready to level up!

CEO - Icarius Fund

Gils Aubry

COO - Level Up Enterprises

Martin Mukasa

CEO - AlphaTrader Firm

Alex Santi

Quant Engineer - Level Up Capital Group

Yoel Tavarez

Director of Logistics - Level up Enterprises

Aaron Stickel

Partner & Executive Director, , Malka Equities

Michael Ursini

speaker

Blake Robert Anderson

Speaker

Chris Belloso

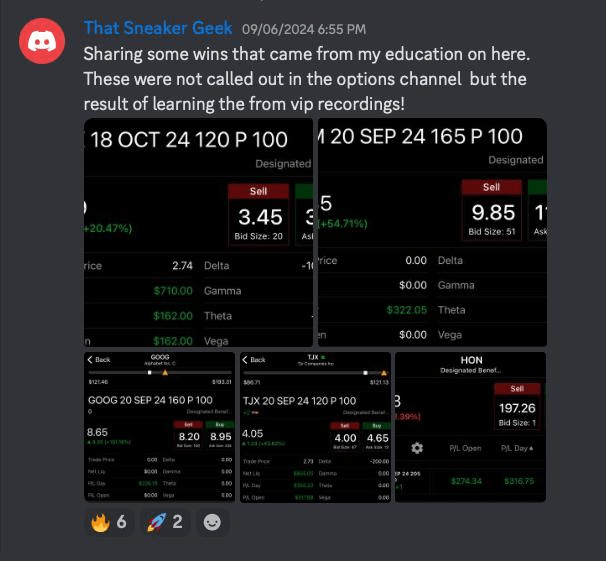

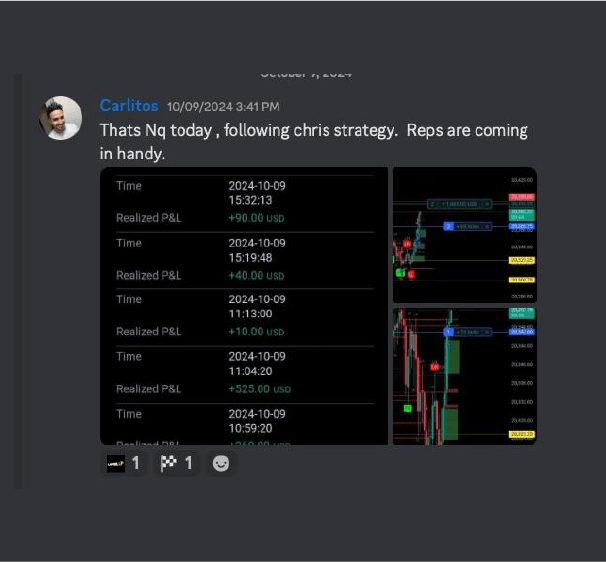

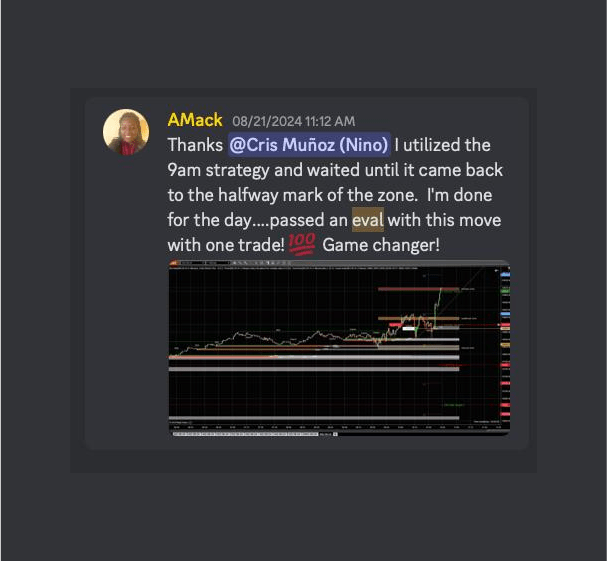

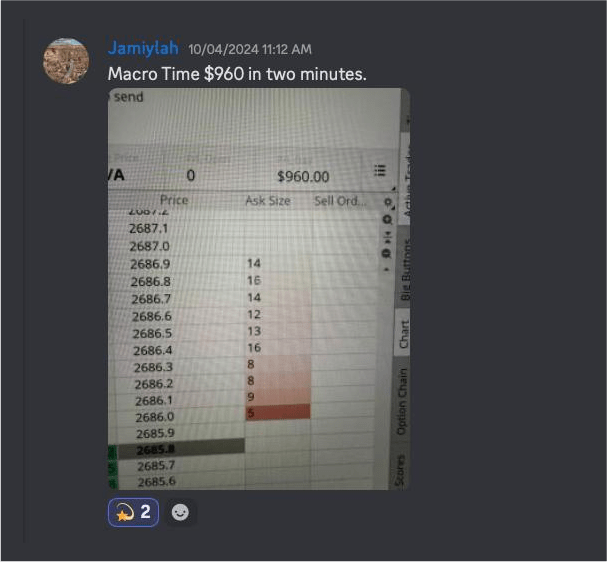

We’ve Empowered Hundreds of Traders to Pass Prop Firm Challenges — You Could Be Next!

At Level Up Enterprises, we’ve developed institutional-grade trading software and strategies that have helped hundreds of traders achieve one of the most critical milestones in their career—getting funded by prop firms. With Level Up Quant Vue and our cutting-edge institutional concepts, you can become the next trader to join the ranks of those who’ve successfully passed prop firm challenges.

Pricing

Secure Your Spot and Invest in Your Trading Future

Platinum

Premium Tickets

- Miami, FL

- December 14-15th

- A-Z Walkthrough Institutional Concepts/Models

- AlphaFX 50K Prop Firm Challenge

- Institutional Entry Model Handbook

- Lab Exercises

- Fireside Chat Panel Sessions with Hedge Fund Managers

- Level Up QuantVue (Institutional Algorithm)

- Suite of Actionable Institutional Alerts

- Post Event Implementation Workshop

Instituional Trading 📈

Unlock Your Trading Potential Join the Level Up Institutional Trading Summit!

Transform your trading in just two days at the Level Up Institutional Trading Summit! Immerse yourself in hands-on exercises and advanced strategies used by top institutional traders. Move beyond retail concepts and master the frameworks that truly drive the markets. With exclusive access to cutting-edge trading software and expert insights you will gain the skills to become a consistent profit generator.

You vs You. Make Sure You Win!

FAQ Question ❓

Frequently Asked Questions

The summit is designed to provide real tactical education on institutional trading concepts. Attendees will learn advanced trading strategies through hands-on exercises, lab sessions, and breakout panels. The goal is to equip traders with actionable insights and techniques used by institutional traders to achieve consistent profitability.

The summit will take place over two days, on the 14th and 15th. Each day will feature a full schedule of educational sessions, exercises, and live market analysis.

This event is ideal for traders looking to level up their skills by diving deep into institutional trading models. Whether you’re an intermediate or advanced trader, the content will enhance your understanding of key concepts and provide tools to refine your trading strategy.

We will cover a wide range of institutional trading concepts, including:

• The Market Maker Model

• Liquidity trading and market structure

• Advanced strategies like Fair Value Gaps, Order Blocks, and Time & Price

• Types of liquidity (session highs), timeframe alignment, and volume imbalances

• Displacement, Order Flow, and institutional algorithm concepts

• Live trading sessions: 9:30 open, 9:50-10:10 macros, and more

Yes, the summit includes several interactive lab exercises designed to reinforce the theoretical concepts covered. Attendees will apply the strategies learned in real-time market scenarios, allowing for practical skill development.

Yes, in addition to group lab exercises, there will be breakout sessions where smaller groups can dive deeper into specific topics. You’ll also have the opportunity to engage with experts for personalized insights during these sessions.

The summit is tailored for traders who already have a foundational understanding of trading. While beginners may find some sessions insightful, the content is primarily designed for traders who are ready to move into advanced, institutional-level strategies.

Unlock Your Trading Potential at the Level Up Institutional Trading Summit 2024

Are you ready to elevate your trading game? Join us at the Level Up Institutional Trading Summit 2024 for an unparalleled opportunity to enhance your skills and knowledge!

- Miami, FL

- December 14-15th

Get An In-Person Ticket for December 14-15, 2024